Political Economy

American shakedown: Police won't charge you, but they'll grab your money

Against Sharing: “Sharing economy” companies like Uber shift risk from corporations to workers, weaken labor protections, and drive down wages.

The Promise of Socialist Feminism: Rebuilding the Left will require drawing on socialist-feminist traditions.

We Aren’t the World: Joe Henrich and his colleagues are shaking the foundations of psychology and economics—and hoping to change the way social scientists think about human behavior and culture.

Of Flying Cars and the Declining Rate of Profit

Other

Will Misogyny Bring Down The Atheist Movement? . . . How can a progressive, important intellectual community behave so poorly towards its female peers?

Richard Dawkins: The Wrongering - Well, I’m going to have to write off Richard Dawkins now. He’s been eaten by the brain parasites.

Why Microsoft Word must Die

This Is John Galt?

[T]he superstition that the budget must be balanced at all times, once it is debunked, takes away one of the bulwarks that every society must have against expenditure out of control. . . . [O]ne of the functions of old-fashioned religion was to scare people by sometimes what might be regarded as myths into behaving in a way that long-run civilized life requires.

Monday, September 22, 2014

Saturday, September 20, 2014

Links Sept 20, 2014

Political Economy

Settler Society, Global Empire: Aziz Rana and Nikhil Singh on the American State

paul krugman’s philosophy of economics, and what it should be

This Isthmus of a Middle State (a brief discourse on productive class and socio-economic status)

Timothy Snyder’s Lies: In Timothy Snyder’s Bloodlands, Hitler and Stalin are one and the same. And the partisans — Jewish fighters included — only encouraged German crimes. (Stalin made Hitler do it!)

A Palestinian Exception to the First Amendment

Other

5 Mind-Blowing Academic Theories as Taught by Classic Movies

The phantom menace of militant atheism (via Jerry Coyne)

Rape Culture in the Alaskan Wilderness

The Treasonous 32: Four-Fifths of Black Caucus Help Cops Murder Their Constituents

The Poverty of Culture: Despite all evidence to the contrary, blaming black culture for racial inequality remains politically dominant. And not only on the Right.

Settler Society, Global Empire: Aziz Rana and Nikhil Singh on the American State

paul krugman’s philosophy of economics, and what it should be

This Isthmus of a Middle State (a brief discourse on productive class and socio-economic status)

Timothy Snyder’s Lies: In Timothy Snyder’s Bloodlands, Hitler and Stalin are one and the same. And the partisans — Jewish fighters included — only encouraged German crimes. (Stalin made Hitler do it!)

A Palestinian Exception to the First Amendment

Other

5 Mind-Blowing Academic Theories as Taught by Classic Movies

The phantom menace of militant atheism (via Jerry Coyne)

Rape Culture in the Alaskan Wilderness

The Treasonous 32: Four-Fifths of Black Caucus Help Cops Murder Their Constituents

The Poverty of Culture: Despite all evidence to the contrary, blaming black culture for racial inequality remains politically dominant. And not only on the Right.

Monday, September 08, 2014

Links Sept. 8, 2014

Political Economy

Feast of the Wingnuts

5 Things Everyone Gets Wrong About Government Spending

The Right’s Working-Class Philosopher

The 7 Strangest Libertarian Ideas

Hard money is not a mistake

The Criminality of Wall Street

Economics Isn't Science or Literature

The right’s jobs debacle: Here’s how to bring unemployment down to zero

Spitting on the working poor: Living wage surcharges and the nickel-and-diming of America

The True Story Of How One Man Shut Down American Commerce To Avoid Paying His Workers A Fair Wage

Fergunson, MO

Ferguson isn’t about black rage against cops. It’s white rage against progress.

Here’s what white privilege looks like

THE 99.99%

Other

Has the Burning Man Bubble Burst?

Feast of the Wingnuts

5 Things Everyone Gets Wrong About Government Spending

The Right’s Working-Class Philosopher

The 7 Strangest Libertarian Ideas

Hard money is not a mistake

The Criminality of Wall Street

Economics Isn't Science or Literature

The right’s jobs debacle: Here’s how to bring unemployment down to zero

Spitting on the working poor: Living wage surcharges and the nickel-and-diming of America

The True Story Of How One Man Shut Down American Commerce To Avoid Paying His Workers A Fair Wage

Fergunson, MO

Ferguson isn’t about black rage against cops. It’s white rage against progress.

Here’s what white privilege looks like

THE 99.99%

Other

Has the Burning Man Bubble Burst?

Saturday, September 06, 2014

Onrushing penis

"Never, in the history of humanity, has a man been at risk of a woman leaping out of the bushes and accidentally impaling herself on his onrushing erect penis." -- PZ Myers

Friday, September 05, 2014

The upward market sloping supply curve (part 1)

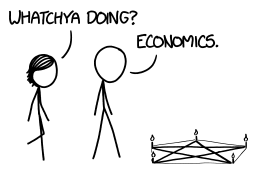

I've been sitting in on the principles of micro- and macro-economics classes, which has been a lot of fun.

But one thing has been bothering me: the justification seems weak for the assertion that market (and aggregate) supply functions are upward sloping. It makes intuitive sense to just say that if the price of a good (or service) rises, the producers of that good will produce more. But four years of economics has trained me not to trust my naive intuition. Instead, I want to set up a model and see what happens in that model. Then I want to carefully consider the relationship of reality to the model's assumptions.

So, let's start with a simple economy where all producers are in perfect competition, are operating at the maximum efficient scale, and no one is making economic profit. Hence, the supply and demand schedule for every individual firm looks like this:

Next, we lower (raise) permanent tax rates so that in general, demand increases (decreases) due to income effects. Not all firms will experience the same effects. Some firms (those making normal goods, which have positive income elasticity) will see demand rise (fall); some firms (those making inferior goods) will see demand fall (rise), and some (those making goods with highly income-inelastic demand) will see little change in demand. Since most goods are normal, with income-elastic demand, we'll focus on the first category. In the short run, these firms experience the following, with D' being the new demand curve with lower tax rates, and D" the new curve with higher rates.

So, yes: quantity supplied increases (decreases) when the price increases (decreases). When prices increase, the firms make a short-run economic profit (labeled EP on the graph); when prices fall, firms experience a short-run economic loss.

Let me take a moment to check my assumptions.

The only dodgy assumption is the upward-sloping marginal cost curve. Because I'm investigating why market supply curves are upward sloping, assuming that marginal costs curves are upward sloping is to implicitly assume the consequent. I want an independent justification. Given that I'm analyzing the short run, we can increase only one factor of production, and labor is the easiest factor to change. So, firms need to pay their existing workers overtime to produce more (obviously increasing marginal costs), or they need to hire more temporary workers (in the short run, firms do not want to commit to a long-run increase in their permanent workforce). Temporary workers are more expensive and less productive, so marginal costs will increase. So I think this assumption is supportable.

However, economists assert that the upward sloping market supply curve is a long run curve, so we need to figure out what happens not just in the short run, but in the long run. That will be the topic of the next post.

But one thing has been bothering me: the justification seems weak for the assertion that market (and aggregate) supply functions are upward sloping. It makes intuitive sense to just say that if the price of a good (or service) rises, the producers of that good will produce more. But four years of economics has trained me not to trust my naive intuition. Instead, I want to set up a model and see what happens in that model. Then I want to carefully consider the relationship of reality to the model's assumptions.

So, let's start with a simple economy where all producers are in perfect competition, are operating at the maximum efficient scale, and no one is making economic profit. Hence, the supply and demand schedule for every individual firm looks like this:

P=Price, Q=Quantity

MC=Marginal Cost, ATC=Average Total Cost

D=Demand, M=Marginal Revenue

Next, we lower (raise) permanent tax rates so that in general, demand increases (decreases) due to income effects. Not all firms will experience the same effects. Some firms (those making normal goods, which have positive income elasticity) will see demand rise (fall); some firms (those making inferior goods) will see demand fall (rise), and some (those making goods with highly income-inelastic demand) will see little change in demand. Since most goods are normal, with income-elastic demand, we'll focus on the first category. In the short run, these firms experience the following, with D' being the new demand curve with lower tax rates, and D" the new curve with higher rates.

So, yes: quantity supplied increases (decreases) when the price increases (decreases). When prices increase, the firms make a short-run economic profit (labeled EP on the graph); when prices fall, firms experience a short-run economic loss.

Let me take a moment to check my assumptions.

- Perfect Competition: The same behavior holds for monopoly and monopolistic competition with rising marginal costs (and all but the most rigidly doctrinaire Libertarian economist will admit that monopolies with falling marginal costs should be regulated by the government), so this is a useful simplifying assumption.

- Maximum Efficient Scale: Not relevant in the short run.

- No Starting Economic Profit: Usually realistic per se.

- Mostly Normal Goods: Usually realistic per se.

The only dodgy assumption is the upward-sloping marginal cost curve. Because I'm investigating why market supply curves are upward sloping, assuming that marginal costs curves are upward sloping is to implicitly assume the consequent. I want an independent justification. Given that I'm analyzing the short run, we can increase only one factor of production, and labor is the easiest factor to change. So, firms need to pay their existing workers overtime to produce more (obviously increasing marginal costs), or they need to hire more temporary workers (in the short run, firms do not want to commit to a long-run increase in their permanent workforce). Temporary workers are more expensive and less productive, so marginal costs will increase. So I think this assumption is supportable.

However, economists assert that the upward sloping market supply curve is a long run curve, so we need to figure out what happens not just in the short run, but in the long run. That will be the topic of the next post.

Tuesday, September 02, 2014

Subscribe to:

Comments (Atom)